Ratings & Reviews performance provides an overview of what users think of your app. Here are the key metrics to help you identify how your app is rated by users and how successful is your review management strategy.

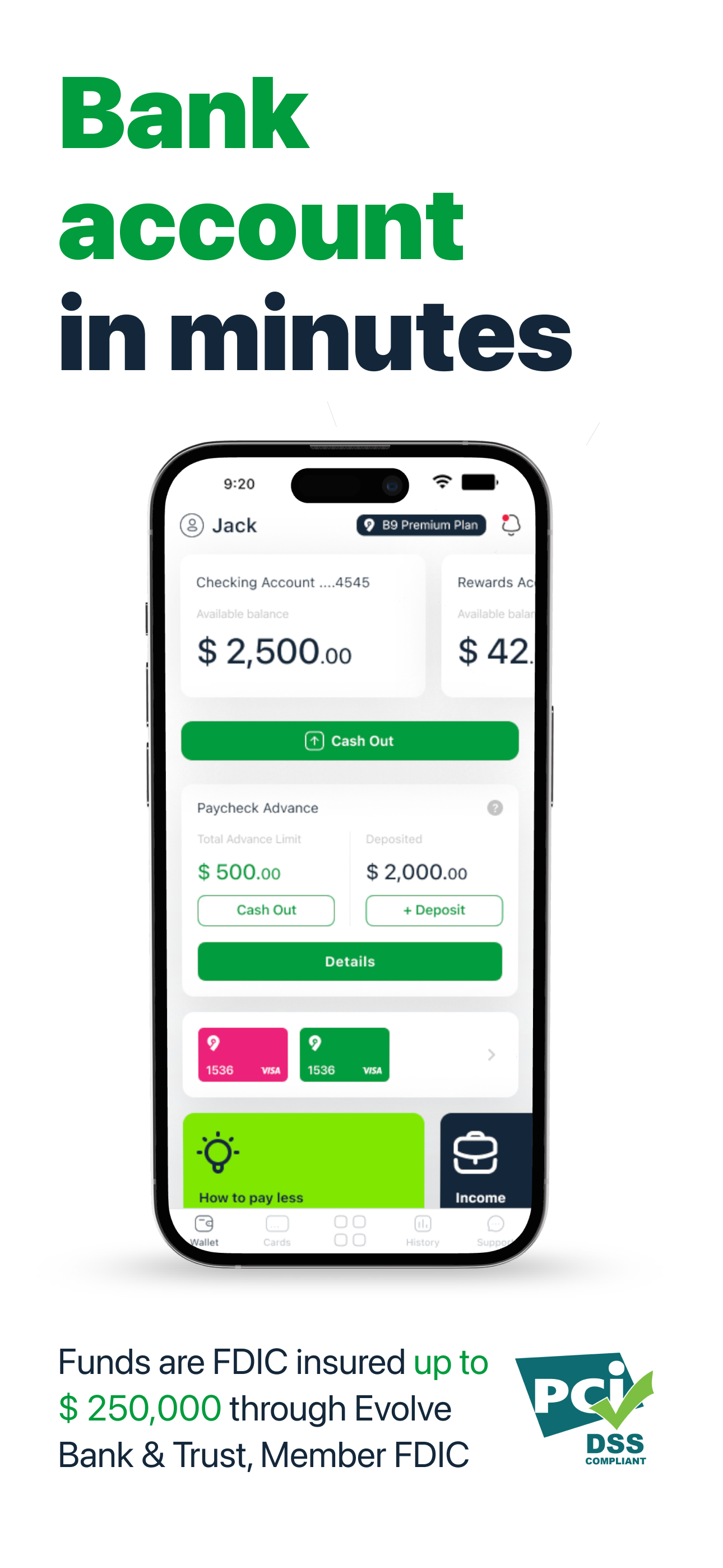

Tired of waiting your next payday? Access your paycheck and get paid when you need to. B9 enables you to advance your cash as you work, eliminating the wait time of your next payday. No interest, no credit checks, and no late fees. Over 1.5 million downloads and counting. Experience the B9 cash advance where you can access up to $500 per pay period to handle your unexpected bills, expenses, and so on.[1] What's more, our credit monitoring feature is included in the B9 Premium Plan, ensuring your credit goals stay on track, all conveniently within the app. Earn up to 5% cash back when you use your B9 Visa® Debit Card for eligible purchases online and in physical stores. Subject to eligibility criteria including spending requirements of $200 in a single calendar month and merchant categories. See T&C for more details HOW IT WORKS: 1 Download the app and open your B9 Account; start depositing your income or paycheck into your B9 Account. (Any recurring direct deposits from multiple employers, side hustles, government benefits, income from rentals, tutoring also qualify.) 2 Check the amount of B9 cash advance you're eligible for, and confirm it for immediate use as you wish. 3 Withdraw or spend your cash advance money — whenever you need it. 4 When your next paycheck deposit comes, your B9 Account will be debited with the amount of cash advanced. 5 The more on-time payments you make, the more of your income we can advance to you over time. Choose your subscription plan: Basic Plan ($11.99 or $0* monthly fee) - B9 Visa® Debit Card with up to 5% cash back - B9 cash advance (up to $100 cash advance per pay period) [1] - Cash advance is available instantly with your B9 Visa® Debit Card - No fee ACH withdrawals to banks accounts - Additional fees apply for instant withdrawals and deposits from and to B9 Account - Instant transfers to other B9 members from your B9 Account at no extra fees Premium Plan ($19.99 or $0* monthly fee) - B9 Visa® Debit Card with up to 5% cash back - B9 Advance℠ (up to $500 of cash advance per pay period) [1] - Cash advance is available instantly with your B9 Visa® Debit Card - Instant transfers to other B9 members from your B9 Account at no extra fees - No fee ACH withdrawals to banks accounts - Additional fees apply for instant withdrawals and deposits from and to B9 Account *We'll waive the subscription fee for your first 30 days of B9 Basic. After that, it's $11.99 a month for Basic or $19.99 for Premium. If you direct-deposit more than $5K/month you'll continue to get your B9 subscription fee free. This does not exempt other fees see bnine.com/tos B9 is not a bank. Banking Services are provided by Evolve Bank & Trust, Member FDIC. The B9 Account and B9 Visa® Card are provided by Evolve Bank & Trust, Member FDIC. [1] B9 advance is an optional, no fee service offered by B9 to its members that requires members to set up a direct deposit to your B9 Account at least once each month. The amount of cash advance a member is eligible to receive will be based on the member's B9 Account history, income deposit frequency and amount, and other factors determined by B9, and may change from time to time. For B9 advance T&C and eligibility requirements apply. Not all users will qualify. Average approved advance for B9 Basic plan is $76 and the average approved advance for the B9 Premium plan is $270 as of September 2024. See T&C or contact B9 via support@bnine.com. May not be available in all states. B9 warrants that it has no legal or contractual claim against you based on a failure to repay a cash advance. B9 will not provide a customer with further advances while any amount their prior B9 advance remains unpaid under the B9 advance service. Privacy Policy: https://bnine.com/privacy-policy