Ratings & Reviews performance provides an overview of what users think of your app. Here are the key metrics to help you identify how your app is rated by users and how successful is your review management strategy.

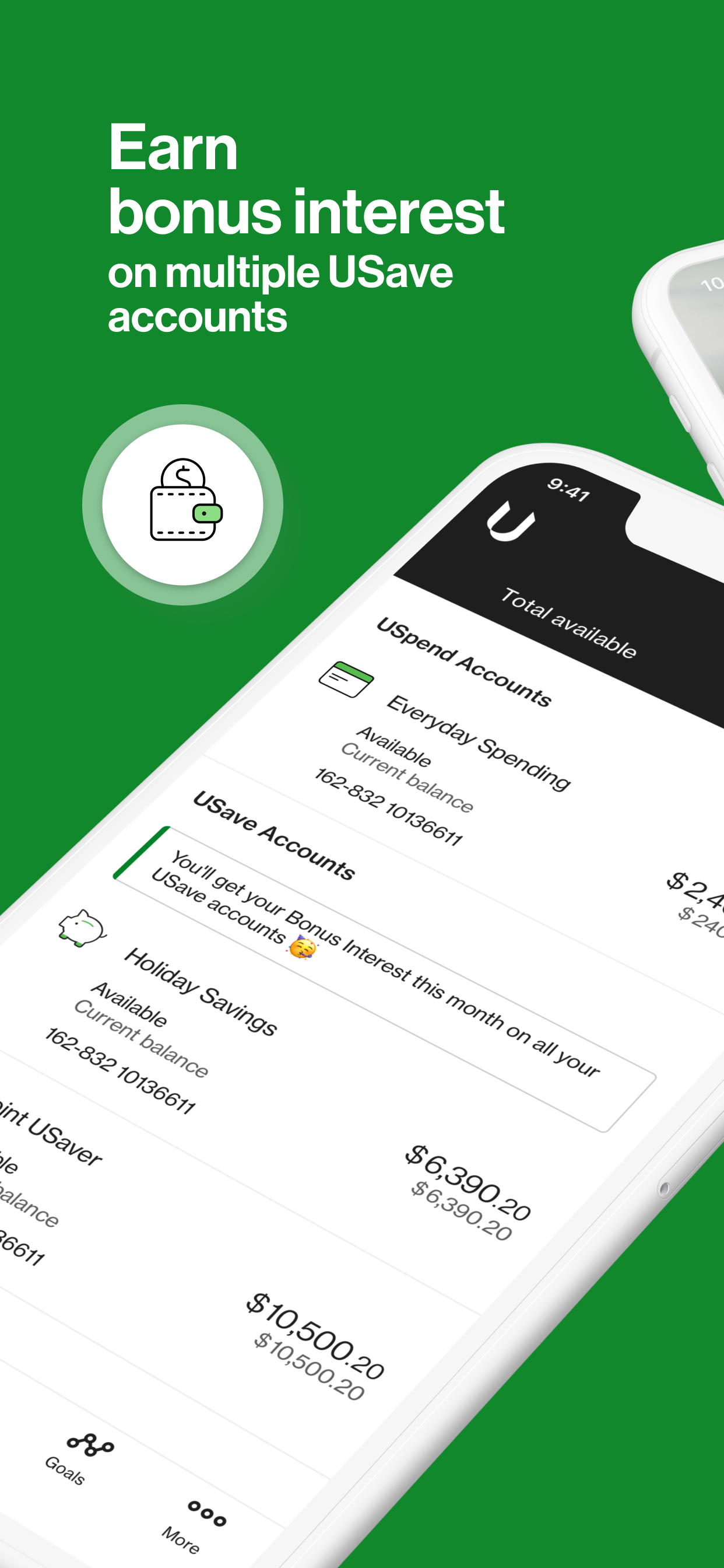

The UBank app is only for our customers still awaiting upgrade. You’ll be able to manage your original UBank products including USave and USpend accounts. If you’re a new customer looking to sign up to new ubank products, check out our upgraded ubank app at https://apps.apple.com/au/app/id1449543099. SAVE, SPEND AND EARN INTEREST FASTER • You can open an account in minutes on the app. • Unlock a competitive bonus interest rate on up to 10 savings buckets (check out our bonus eligibility criteria in the app or at https://www.ubank.com.au/help/original/og-everyday-banking/account/how-do-i-qualify-for-the-usave-bonus-interest-rate ). • No UBank fees on USave and USpend accounts. NEED A TRAVEL BUDDY? WE GOT YOU • We don’t charge international or ATM withdrawal fees overseas (but ATM owners and stores might). • Super secure overseas banking. • Push notifications that ensure you approve all payments. WHY DIGITAL BANKING? IT’S SIMPLE. • With no branches, we pass on the savings to you and our other 600,000 customers. • Great rates and Aussie-based support teams. • Extra convenience – pay bills with BPAY or spend on-the-go with Apple Pay, Garmin Pay or Fitbit Pay. • Super quick and secure log in with Touch or Face ID (on compatible devices). • Your savings with UBank are government guaranteed, up to the value of $250,000 per customer per financial institution. Important information: Subject to network provider coverage. ® BPAY is a registered trademark of BPAY Pty Limited ABN 69 079 137 518. Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. Any advice has been prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether it is appropriate for your circumstances. We recommend that you read and consider the relevant Terms and Conditions for our products at https://www.ubank.com.au/original-products/terms-and-conditions before making any decision. Credit criteria and fees and charges can apply. Target Market Determinations for these products are available at https://www.ubank.com.au/target-market-determinations. UBank is a division of National Australia Bank Limited ABN 12 004 044 937, AFSL and Australian Credit Licence 230686. UBank is the issuer of the USpend and USave products. For our home loan products, the credit provider is AFSH Nominees Pty Ltd ABN 51 143 937 437 Australian Credit Licence 391192. UBank is the mortgage manager for our home loan products.