Ratings & Reviews performance provides an overview of what users think of your app. Here are the key metrics to help you identify how your app is rated by users and how successful is your review management strategy.

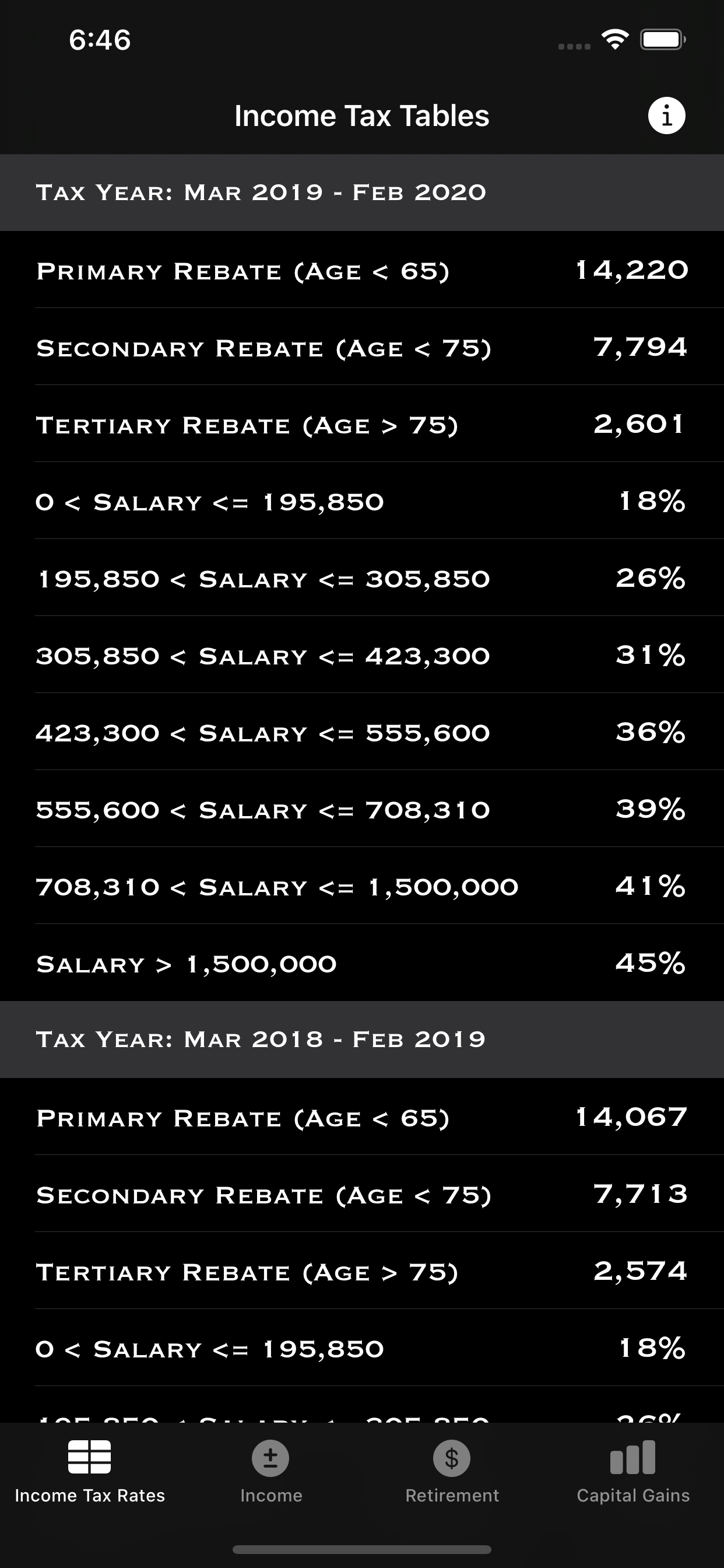

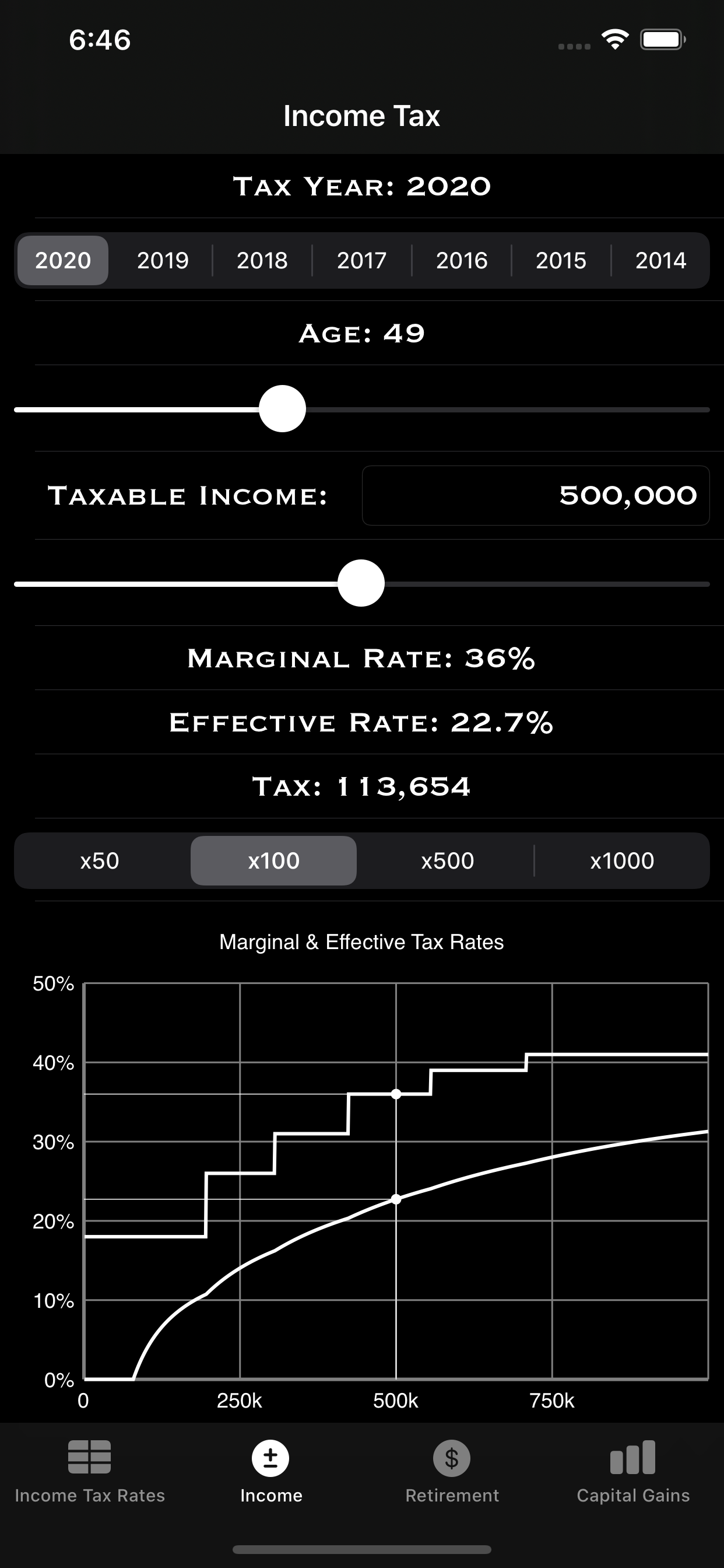

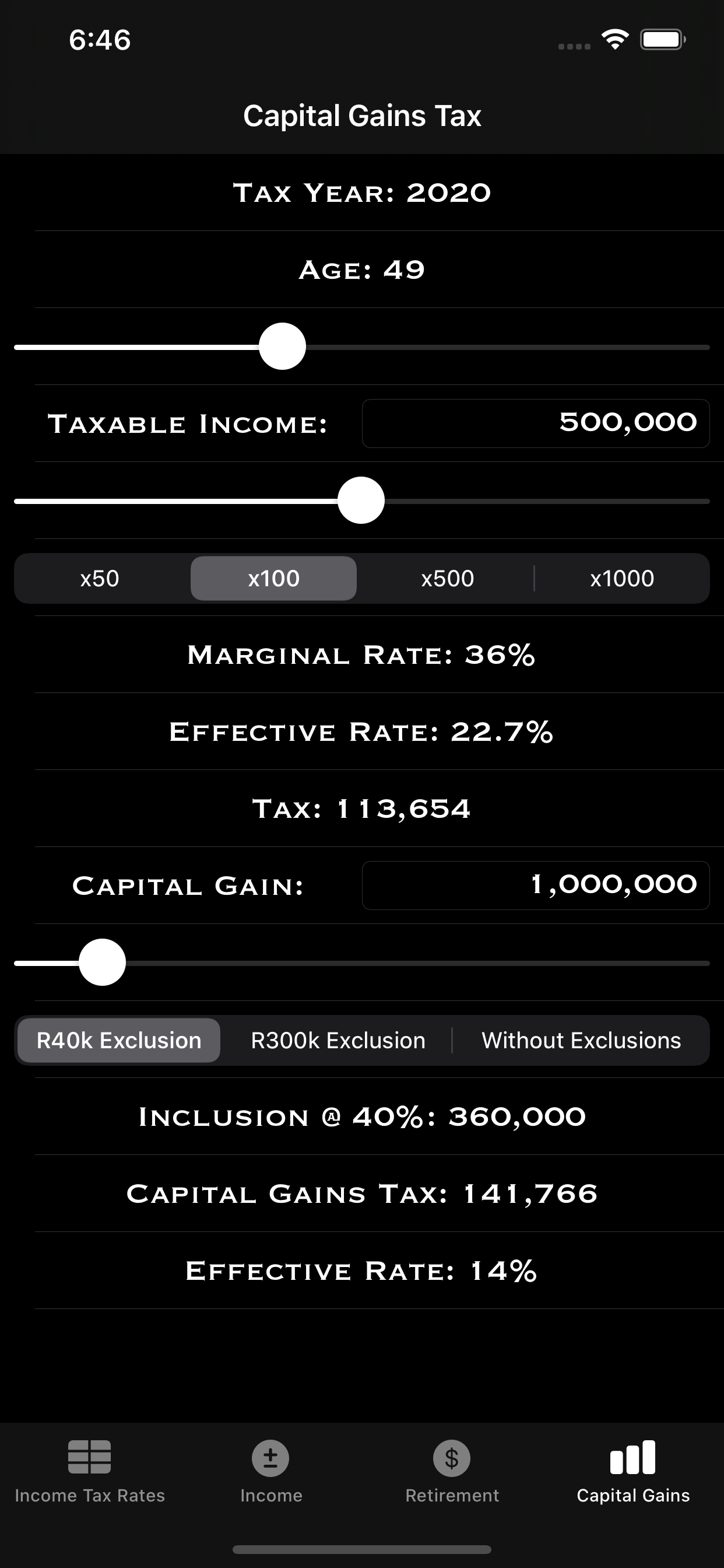

SATax is a South African tax calculator with updated rates for the 2020 tax year provided by SARS. It allows you to calculate your marginal and effective tax rates, as well as the tax amount, depending on your taxable income and age, and shows you these graphically so that you can appreciate how these change with taxable income. You can select from the previous six tax years as well, to compare how rates have changed over the years. It also provides a table of seven years of tax rates (rebates, taxable income brackets, and marginal rates). It also allows you to calculate capital gains tax, dependent on your marginal rate (which depends on your taxable income), under three different exclusions (none, R40k which is the annual rate, and R300k which is the rate on death). Finally, it includes tax calculation for retirement funds' benefits on withdrawal and retirement.