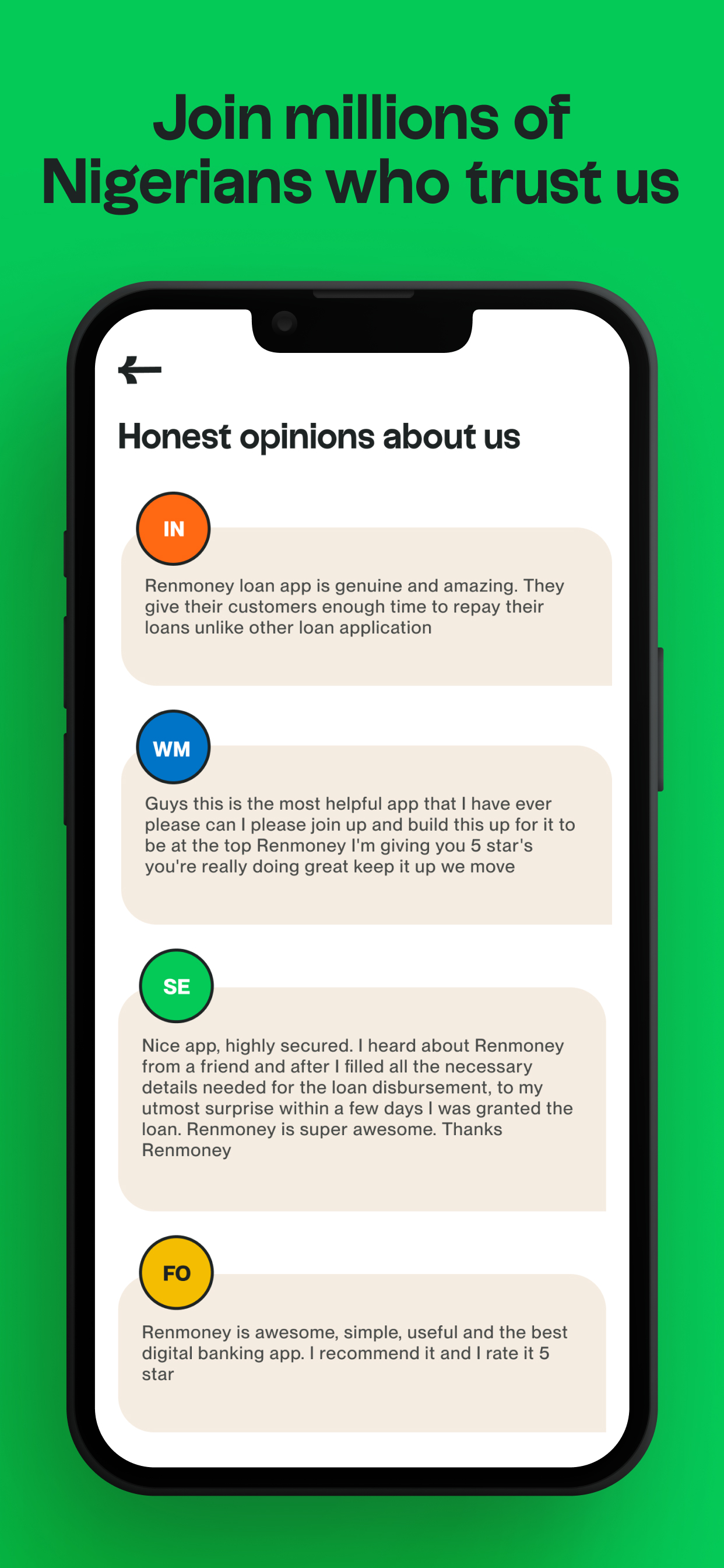

Ratings & Reviews performance provides an overview of what users think of your app. Here are the key metrics to help you identify how your app is rated by users and how successful is your review management strategy.

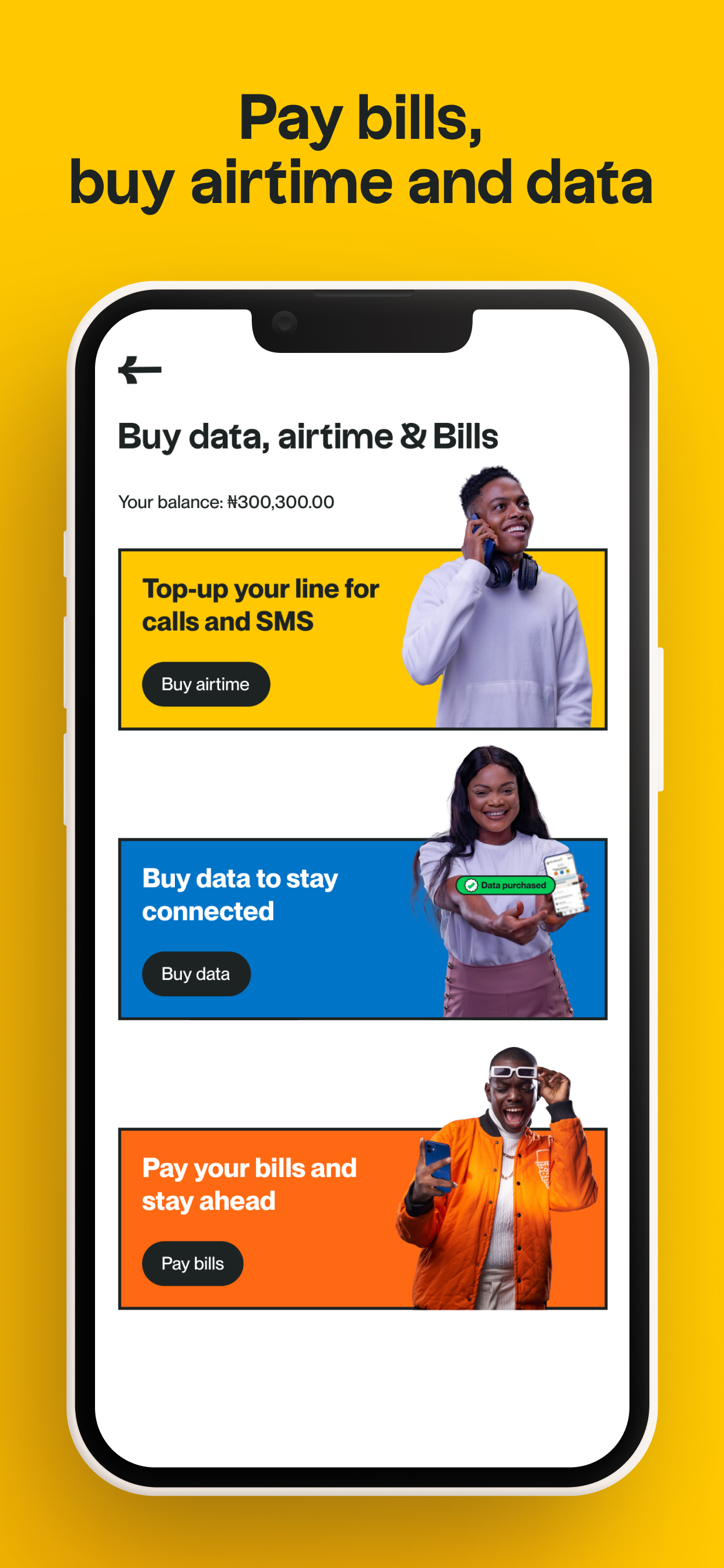

You can get a quick loan on the RENMONEY MFB LIMITED app in just a few steps. Our loans are for people who are employed, self-employed or business owners. So, if you need an instant personal or business loan, you can borrow from ₦6,000 to ₦6,000,000 and repay in 3 - 24 months. The RENMONEY MFB LIMITED app gives you instant access to quick loans, savings and investments with competitive interest rates. Here's what you get with a RENMONEY MFB LIMITED loan Fast and convenient loans from ₦6k to ₦6m Flexible repayments between 3 - 24 months Money in your bank account in minutes Lower rates and longer tenure on your next loan No paperwork No collateral or guarantor needed No hidden charges - you always see your loan terms before you commit We keep it simple, no confusing language Support team is always available to help Secure processes The loan process is simple. • Download the mobile app • Share some information about yourself • Verify the information you have provided • Get money in your bank account once you’re approved Want to save? You can set up a Smart Goal and save towards milestones that matter to you or set up a Save Easy plan and save what’s convenient. Whatever plan you choose, you’ll earn attractive interest on your money. Want to invest? Make your money work for you with a RENMONEY MFB LIMITED Fixed deposit account. Invest your money for a fixed duration and earn high interest. What you get with RENMONEY MFB LIMITED Savings and Fixed Deposit Earn up to 13% interest per annum Save and invest securely and on your own terms Build a savings habit Set up automatic periodic savings Why choose RENMONEY MFB LIMITED? We’re convenient and secure You can see and access your account at any time We’re regulated by the Central Bank of Nigeria (CBN) Your savings and deposits are insured by the Nigeria Deposit Insurance Corporation (NDIC). About RENMONEY MFB LIMITED We’re a fintech lending company located in Lagos state, Nigeria and operating under a Microfinance Bank license. We offer personal and business loans from ₦6,000 to ₦6,000,000 to employed and self-employed individuals as well as high interest savings and fixed deposits. RENMONEY MFB LIMITED INTEREST RATE AND LOAN REPAYMENT With RENMONEY MFB LIMITED you can apply for a loan of ₦6,000 - ₦6,000,000 without collateral and repay in 3 - 24 months. Monthly interest rates range from 2.4% - 9.33% and the maximum Annual Percentage Rate (APR) is 35.76%. No other fees are charged. Representative example: Loan Amount: ₦2,000,000 Loan Tenure: 12 months. Number of Repayments: 12 Monthly Interest Rate: 2.4% Monthly repayments: ₦214,667.00 Total amount payable: ₦2,576,000.00 APR: 28.8%. Customer information security and privacy The RENMONEY MFB LIMITED app has been developed using the best security and privacy standards to ensure absolute data security. When you download the RENMONEY MFB LIMITED App, we will ask for your permission to verify your personal and financial information. Our app is secure to use, and we will not share your information with third parties without your consent. Here’s how you can contact us Email: hello@renmoney.com Call: 0700 5000 500 Visit: renmoney.com Like on Facebook: https://web.facebook.com/renmoney Follow on Instagram: https://www.instagram.com/renmoneyng/ Follow on Twitter: https://twitter.com/renmoney Follow on Medium: medium.com/@renmoney Visit our offices Ikoyi: 23, Awolowo Road Ikoyi, Lagos, Nigeria Opebi: Pentagon Plaza, 23 Opebi Road, Ikeja, Lagos, Nigeria Surulere: Kings Plaza, 80, Adeniran Ogunsanya Street, Surulere, Lagos, Nigeria