Ratings & Reviews performance provides an overview of what users think of your app. Here are the key metrics to help you identify how your app is rated by users and how successful is your review management strategy.

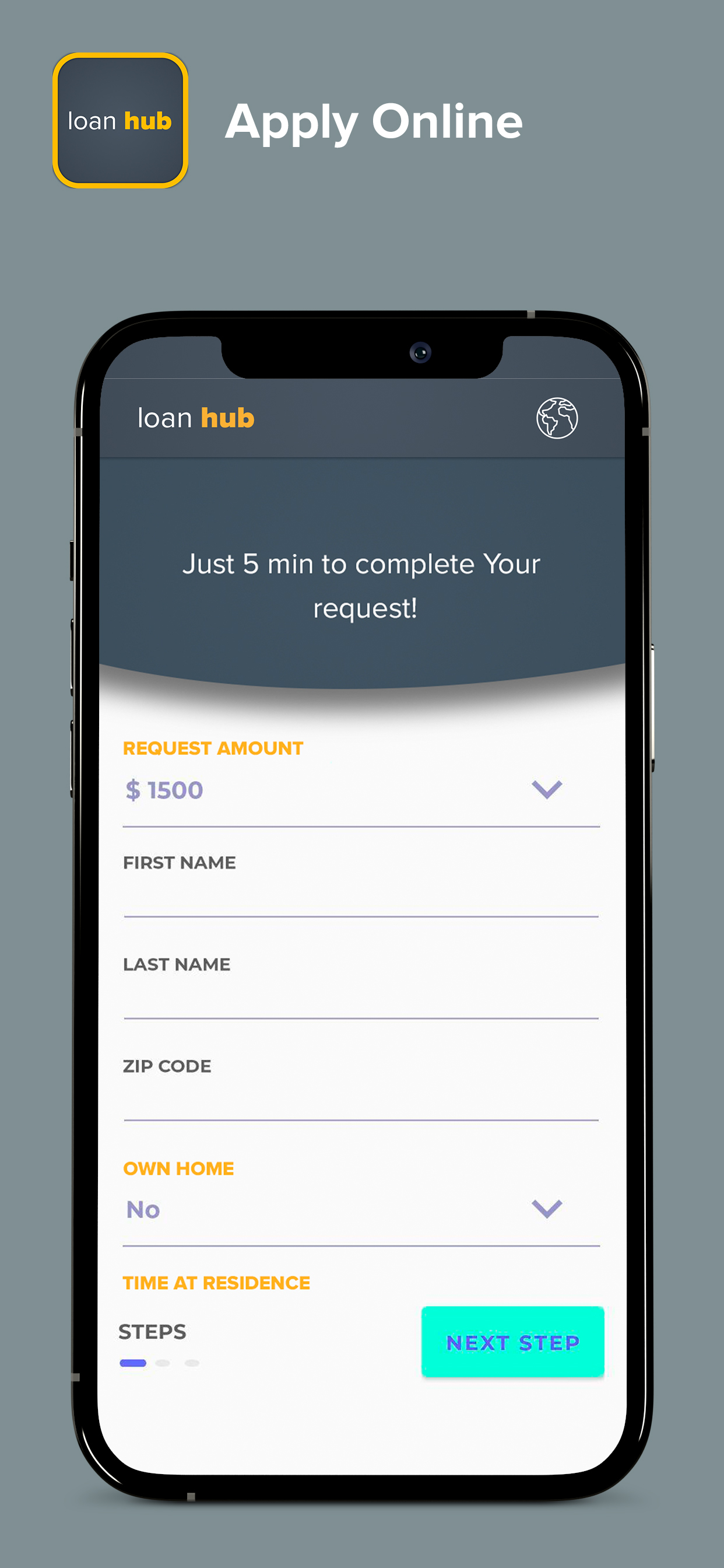

Choosing a Personal Loan that Meets All Your Requirements and Expectations Our app is your personal loan picker that monitors the loan market and selects the best options, taking into account the entered parameters - loan term, grace period, loan amount and many others. Using the app, you can find the best bad credit loans (best options for those who cannot get a regular bank loan), short-term loans, business loans and other cash loan options. With this online service, you can make all the necessary calculations and apply for a loan. We have done a serious job so that you can make the best choice. Here are some important features of the app that you should be aware of: - Comparison of loan offers. By comparing bank cash loans or offers from other lenders, you can choose the best product. - A selection of the best credit cards that meet your requirements for credit limit, free withdrawal and grace period. - Search for the best online loans, small business loan offers and payday loans for any of your needs. - Selection of business loans including small business loan or large loan with favorable terms of use. - A handy loan calculator that is suitable for both short-term loans and long-term bank loans. - View for the ratings of lenders providing financial products - credit cards, payday loans, online loans and so on. - Cooperation with the best banking organizations including Citibank, Discover Bank, Marcus by Goldman Sachs, Wells Fargo, Axis Bank, ICICI Bank, SBI Bank, HSBC Bank, Raiffeisen Zentralbank, Home Credit Bank. Our goal is to provide you with the best personal loan option for all your preferences. Lending Terms You can take out a loan on the following conditions: - Minimum loan amount is $ 1,000 - Maximum loan amount is $ 300,000. - Minimum loan repayment period - 61 days - Maximum loan repayment period - 15 years - Annual percentage rate of charge (APR), which includes all commissions, ranges from 0% to 30%. What Happens if I Do Not Pay on the Loan? Both cash loans and online loans are required to repay. If you violate the bank loan conditions, the lender will impose penalties in the form of a penalty fee, an increased interest rate, up to a legal claim. In addition, your credit history will deteriorate, which will indicate credit risks when interacting with you - many banks will refuse to issue credit cards and even small bank loans. We recommend making all payments on time. Having financial difficulties, you can negotiate with a lender to restructure your debt. Loan Calculation Example Each personal loan has a specific overpayment amount according to an interest rate. Before applying for cash advance loans or business loans, you must consider all the possible risks. If you took out a personal loan of $100,000 for a period of 12 months at 10% per annum, we have the following example for calculating a loan: - The total refund amount is $ 105,499.06. - The monthly payment is $ 8,791.59. - The overpayment amount is $ 5,499.06. All calculations can be done using the built-in calculator. Our Partner Banks Here are some banking organizations and lenders we cooperate with: Citibank, Discover Bank, Marcus by Goldman Sachs, Wells Fargo, Axis Bank, ICICI Bank, SBI Bank, HSBC Bank, Raiffeisen Zentralbank, Home Credit Bank etc. Summary From bad credit loans to best credit cards and cash advance loans, our app is the ultimate loan picker for individuals and organizations. We do not promote banks and other lenders. Our goal is to provide you with the available offers saving you time and effort.